Much has been made of the “high” auction costs of carbon allowances under the Climate Commitment Act during the first year of operations. Opponents of the CCA have reacted to auction settlement prices as a reason to amend or repeal the program.

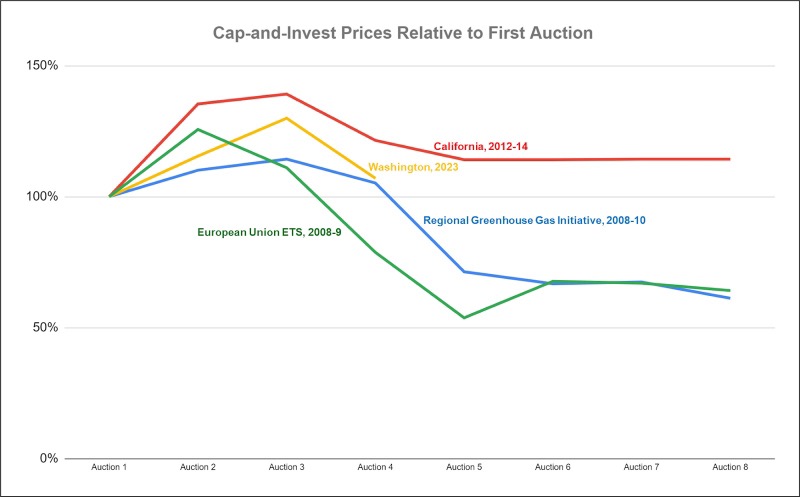

Early peaks in new carbon pricing programs, however, are not uncommon.

As the California, RGGI and European carbon trading programs were implemented, each saw a peak in compliance costs during the first nine months. The clearing prices of subsequent auctions moderated between 18-52% by the fifth auction. Washington’s fourth quarterly auction mimicked this price moderation curve.

That prices would modulate after the initial auctions fits with the design structure of program compliance. Covered entities may have already secured enough allowances in 2023 to be compliant with the program into late-2027. As designed, the first three years of the Climate Commitment Act require 30% of any covered party’s annual emissions to be matched by allowances retired in November of the following year. The majority of allowances for the four-year “compliance period” are not due until November 2027, allowing for longer-term planning and flexibility after the first several auctions.

This is a key distinction from a carbon tax. Unlike a carbon tax, a cap-and-invest program like the CCA lets the market find a price that reflects the true cost of pollution abatement across compliance periods. Covered entities have the freedom to buy allowances at auction, sell allowances on the secondary market to other emitters who can’t cut pollution as cost-effectively, or to invest in cleaning up their operations so they don’t need additional allowances at all.

If Washington continues to follow this pattern of higher initial prices, the March 8th auction would settle in the low $40/ton range. (The risk of repeal may put further downward pressure on allowance prices, as some entities buy fewer units or sell units to mitigate risk.)

Auction results will be made public tomorrow. If this trend continues and is consistent with other carbon pricing markets, the compliance cost for implementation of our pollution cap will continue to decline.

Meanwhile, the Washington State Legislature took a big step to address any financial impact of the Climate Commitment Act on low and moderate-income Washingtonians. They authorized $200 clean energy grants beginning this year to mitigate any compliance costs that are passed by polluters onto low-income Washington families. These credits on residential electricity bills – as well as credits for farmers – are funded from the Climate Commitment Act.

The legislature also took steps to refine the CCA cap-and-invest program, and to advance linkage with carbon markets in California and Quebec, recognizing that larger markets can provide greater efficiency and price stability.

As auction prices continue to settle down, skepticism goes up about opponents’ inflated claims of fuel cost impacts.